BOFIT Weekly Review 04/2015

Slowing Chinese GDP growth approached 7 % in 2014

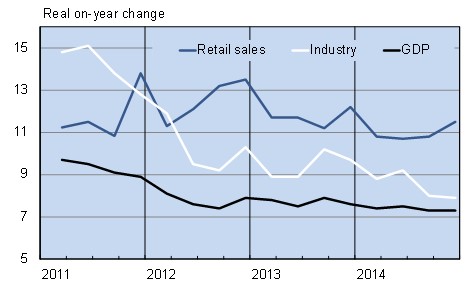

China’s economic growth decelerated from 7.7 % in 2013 to 7.4 % last year. Fourth quarter GDP growth was 7.3 % y-o-y, or 1.5 % q-o-q. Growth in domestic consumption provided more than half of all economic growth. The service sector was the fastest growing part of the economy. Its contribution to GDP last year rose to 48 %, while manufacturing generated about 43 % of GDP.

GDP, industrial output and growth in retail sales, %

Source: Macrobond

The steady decline in growth of fixed capital investment continued, falling from 19 % y-o-y in 2013 to 15 % last year. As expected, construction investment slowed. Infrastructure investment, however, climbed over 20 % y-o-y.

Retail sales grew 11 % last year in real terms, while real wages were up about 8 % y-o-y. The structure of retail trade is undergoing a rapid transformation. Online retail last year accounted for over 10 % of retail sales. Online sales volumes were up 50 % y-o-y in 2014.

Commenting on employment trends, officials at China’s National Bureau of Statistics noted that the unemployment rate in cities was 5.1 % last year – a percentage point higher than China’s official unemployment figure has been. The NBS time series based on survey results have yet to be published, even if the NBS has indicated it plans to do so.

Economic growth is expected to slow this year and next. The IMF this month lowered its forecast for China by 0.3 percentage points to 6.8 % for 2015 and by 0.5 % percentage points to 6.3 % for 2016. The now-apparent slowdown in investment growth is likely to continue. Moreover, China is not expected to provide economic stimulus on a scale of recent years, but instead boost its emphasis on getting debt under control. The World Bank this month released its latest global outlook, which sees the Chinese economy growing slower than in its earlier forecasts. The World Bank expects economic growth of about 7 % in 2015 and 2016.