BOFIT Weekly Review 03/2015

Lower commodity prices boost China’s trade surplus

The December foreign trade numbers provided a pleasant surprise for China, with the value of exports increasing 10 % y-o-y and the drop in the value of imports a mere 2 %. Lower import prices helped push China’s trade surplus in 2014 to a record $380 billion, an increase of nearly 50 % from the previous year. Chinese exports increased by 6 % last year, while imports rose less than 1 %.

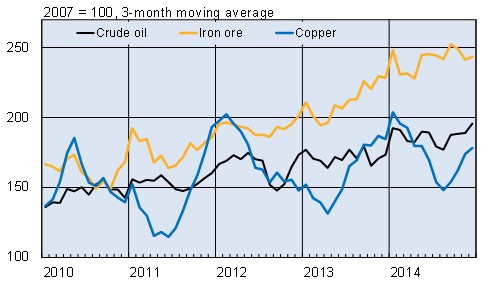

The drop in the value of imports reflected lower commodity prices globally, and led to an increase in import volumes. The volume of crude oil imports last year climbed 9 %, while the volume of iron ore imports rose 14 %. China imported more crude oil than ever in 2014, about 308 million metric tons. The volume of iron ore imports rose to a record 933 million tons. The volume of copper imports increased 6 %, boosted in part by a sharp drop in copper prices towards the end of last year. Coal imports, in contrast, declined by 11 %. The October introduction of new tariffs on coal imports to support domestic coal production appeared to have no significant impact on coal imports, which declined steadily throughout 2014.

The fall in the prices of imported commodities has provided China with an opportunity to build up its strategic reserves of crude oil and also reserves of other basic commodities. Moreover, lower commodity prices could lead to the substitution of poorer-quality domestic production with imports. Thus, higher import volumes do not directly reflect a rise in demand for commodities.

Import volumes of key commodities to China

Source: Macrobond