BOFIT Weekly Review 02/2015

For the first time in several years, the yuan loses ground against the dollar

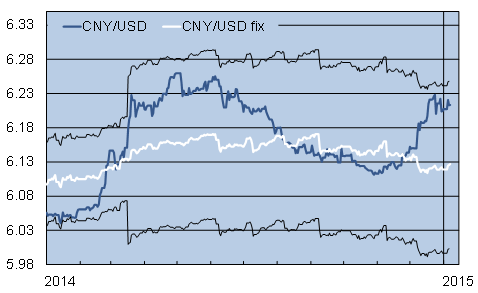

After years of steady appreciation, the yuan last year lost about 2.5 % of its value against the US dollar. The last time the yuan showed an on-year drop against the dollar was in 2009. In the first half of the year, markets were surprised by an unexpected depreciation of the yuan against the dollar, even as most economic fundamentals pointed to on-going yuan appreciation. Part of the weakening reflects deliberate central bank measures to curb speculation on yuan appreciation and prepare markets for the widening of the yuan-dollar trading band.

The People’s Bank of China doubled the width of the trading band in March, allowing a daily divergence of 2 % from the central bank’s daily fixing of the yuan-dollar rate. The move was intended to give markets greater power in formation of the yuan’s external value. The trading band was last widened in April 2012. With these measures, the PBoC ushers in market-based exchange rates and promotes internationalisation of the yuan.

Following the widening of the trading band, the yuan showed more volatility and resumed appreciation. Towards the end of the year, however, slower economic growth and cut in reference rates, along with the improving performance of the US economy, resulted in yuan depreciation against the dollar. The yuan continued its appreciation trend against the euro in the second half, finishing the year up about 10 % against the euro.

Yuan-dollar exchange rate and trading band limits (black)

Sources: Macrobond and BOFIT