BOFIT Weekly Review 02/2015

Current forecasts see Chinese economy growing by about 7 % in 2015

China’s indexes of manufacturing purchasing mangers (PMI) indicated further slowing of industrial output growth in December. The fall in growth of the service sector seems to have levelled off, however. The pace of retail sales growth and the services PMI reading have not changed significantly in recent months. The final GDP growth figure for 2014 is expected to be just over 7 %.

The estimates by a number of observers indicate that the slide in oil prices could probably add half a percentage point to GDP growth this year. Given that current economic growth is still boosted by excessive fixed capital investment and rising indebtedness and thus has no sustainable basis, the oil price boost is unlikely to reverse China’s general trend towards a lower-growth paradigm. However, lower oil prices will relieve the need for fiscal and monetary stimulus measures.

Most leading forecasting institutions still see GDP growth above 7 % this year. Such strong growth will not come easily, however. Recent price swings on mainland China stock exchanges and revelation of a large real estate developer on the brink of bankruptcy provide fresh reminders of systemic risks lurking in the wings.

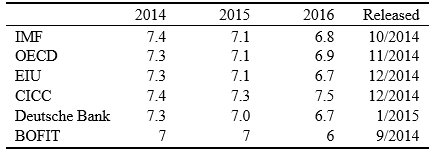

Recent GDP growth forecasts for China, % p.a.