BOFIT Weekly Review 01/2015

China’s stock markets end the year on an upswing

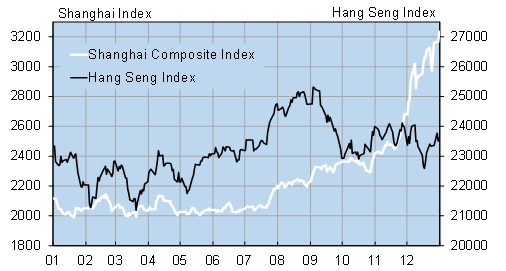

Mainland China stock exchanges ended the year with a strong sprint. The Shanghai Composite Index was up 21 % for December and, even with the rollercoaster volatility, finished the year up 53 %. Share prices on the Shenzhen stock exchange also rose, with the Shenzhen Composite Index up 34 % for the year. The rise in Hong Kong was much more subdued, with the Hang Seng Index up just 1 % for the year.

The surge in share prices reflects the increased interest of mainland Chinese in equities as yields on other forms of investment such as real estate and bank deposits have declined. The volume of share trading also exploded in the final two months of the year as new capital accounts were opened at a record pace.

There has been lacklustre response to “Through Train” cross-trading in listed shares on the Shanghai and Hong Kong stock exchanges, launched in mid-November. Foreign investment into the mainland China stock exchanges has been particularly weak. Through-train trading accounted for only about 1 % of the daily trading volume on the Shanghai exchange. Trading volumes have been nowhere near the ceilings imposed on the amounts of trading allowed under the arrangement. For the Shanghai exchange, just 25 % of the 300 billion yuan (€39 billion) quota had been used and just 4 % of the Hong Kong stock exchange’s quota of 250 billion yuan.

Main share index trends in Shanghai and Hong Kong in 2014

Source: Macrobond