BOFIT Weekly Review 17/2015

Private demand down sharply in Russia

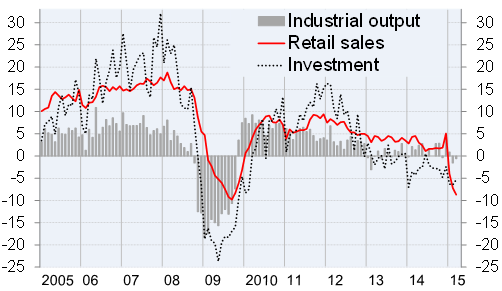

Following December’s shopping spree sparked by the ruble’s fall, the volume of seasonally adjusted retail sales fell three months in a row. Thus, first-quarter retail sales were down nearly 7 % from 1Q14, due in part to another shopping spree in February and March 2014. Food and non-food goods sales both contracted by virtually the same amount in 1Q15.

Although nominal wages were up 6.5 % y-o-y in the first quarter, Russia’s nearly 17 % inflation rate meant that real wages had declined more than 8 % since 1Q14. The February 1 pension hike that increased February pensions to over 13 % y-o-y in nominal terms moderated the drop in real household incomes.

Fixed capital investment has been sliding down for about two years now. The rate of decline increased in 1Q15, when investment was down 6 % y-o-y. The corresponding change in the construction sector was -5 % y-o-y.

Industrial output in the first quarter was down only about 0.5 % y-o-y. Higher production of coal, oil and metallic ores increased output of mineral extraction industries to over 0.5 % y-o-y in the first quarter. Exports of oil and petroleum products were also up.

Manufacturing output in the first three months of the year was down about 1.5 % from a year earlier. In addition to continuous growth in oil refining, production of certain other basic commodities increased notably. Part of this growth may be due to the weak ruble. For food production, Russian countersanctions and other import restrictions are also likely having an effect. In any case, the contribution of the ruble is fading as the ruble’s real exchange rate rebounded strongly in the past three months on high inflation in Russia and the rise in the ruble’s nominal exchange rate. On the other hand, domestic industries should get considerable support from defence spending, which was up over 50 % y-o-y in the first quarter.

Change in core indicators of domestic demand and industrial output, % y-o-y

Source: Rosstat